,

Exclusive Eurocoke 2025 Summit Analysis Reveals Three Structural Shifts Creating Immediate Alpha Opportunities

While the market obsesses over China's 240Mt steel demand destruction through 2050, institutional investors are missing the real story unfolding right now. Last week's Eurocoke 2025 Summit exposed a metallurgical coal market undergoing fundamental restructuring—not simple decline.

At current FOB Australia pricing of $180/t, 37% of Australian production and 52% of US mines operate at a loss. This technical floor isn't sustainable, yet the market hasn't priced in what happens when Premium Low Volatile (PLV) supply peaks in 2028 while blast furnace decarbonization timelines extend.

The math is stark: Indonesia's coke exports will surge from 2.6Mt to 12.7Mt by year-end, overtaking China as the world's largest exporter. This isn't gradual evolution—it's real-time market disruption creating a quality bifurcation that current models completely miss.

PLV supply maxes out by 2028 just as steel decarbonization delays extend traditional steelmaking timelines. The quality premium that emerges will reward assets positioned in premium hard coking coal grades.

While India adds 311Mt of steel capacity through 2050, growth is backend-loaded post-2030. Australian regulatory pressure constrains premium supply today. This timing mismatch—immediate supply constraints versus future demand growth—represents the market's most overlooked opportunity.

Australian constraints (accelerating since June 2022) create valuation premiums for non-Australian metallurgical coal assets. Canadian and US premium producers benefit as the world's largest exporting region faces mounting regulatory headwinds.

Post-M&A activity has concentrated the industry toward pure-play metallurgical coal producers, with diversified miners either exiting or significantly reducing exposure. This consolidation increases pricing power among remaining players controlling premium assets—exactly when quality differentials matter most.

The companies that recognize this isn't a simple demand decline story, but rather fundamental market restructuring, will capture outsized returns. The data reveals three actionable strategies:

While consensus chases the "metallurgical coal decline" story, the Summit data exposes a market caught between competing forces: immediate supply constraints versus backend-loaded demand growth, quality scarcity versus volume abundance, regulatory pressure versus industrial necessity.

The timing of these structural changes—with supply constraints emerging before demand destruction fully materializes—creates the critical investment opportunity highlighted throughout the summit presentations.

Download DBX Commodities' Comprehensive Eurocoke 2025 Summit Analysis

Our exclusive 8-page report includes:

✓ Cost curve positioning for 50+ global producers - Identify which assets survive the $180/t technical floor

✓ PLV supply projections through 2030 - Quality grade breakdowns revealing the premium scarcity timeline

✓ Indonesian disruption scenarios - Trade flow implications as coke exports surge 390% by year-end

✓ Regulatory timeline analysis - Australian policy impacts on global supply constraints

✓ Strategic investment positioning - Three actionable strategies for capturing structural alpha

"Rather than simple volume declines, the market is evolving due to geographic demand shifts, quality-driven supply constraints, regulatory pressures, and geopolitical factors." - DBX Commodities Executive Summary

This intelligence is already moving institutional positions. Don't get left behind trading yesterday's thesis.

Delivered instantly. No spam. Professional intelligence for serious investors.

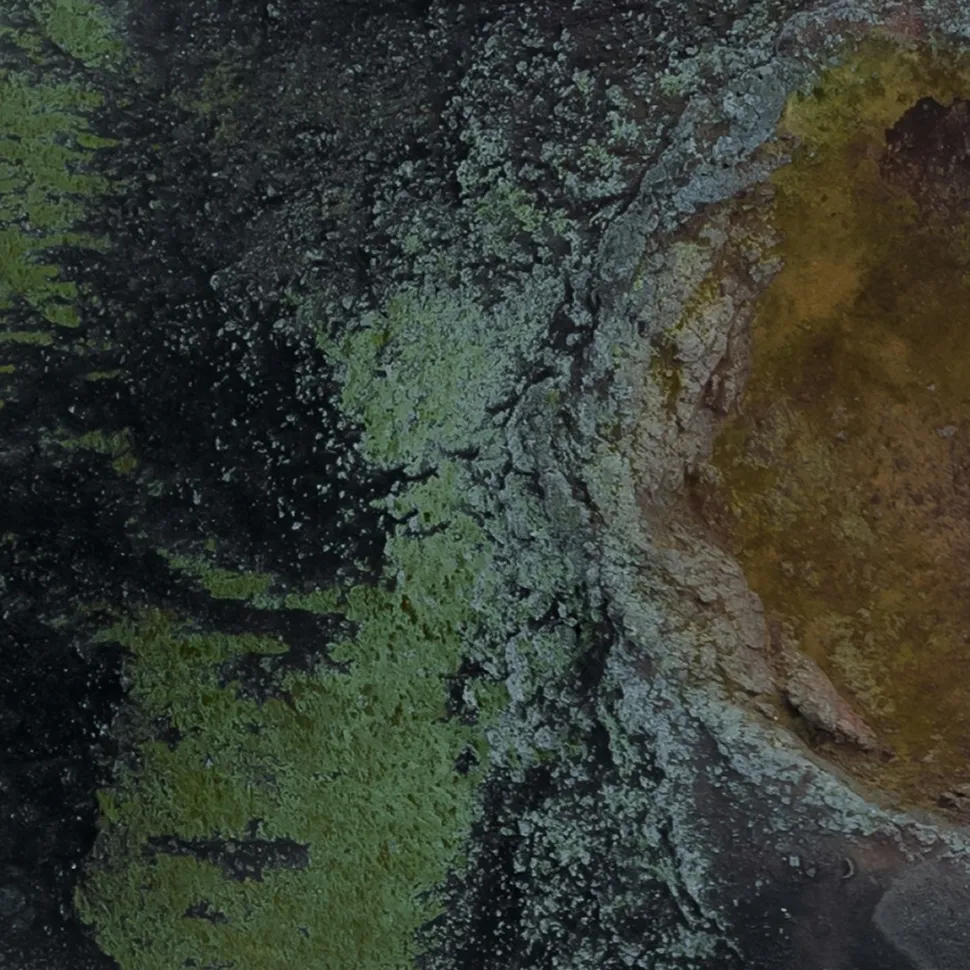

About DBX Commodities: Delivering real-time intelligence for global commodity markets using satellite imaging, AI, and proprietary analytics. DBX provides the most accurate and timely insights into flows, inventories, and industrial activity across iron ore, coal, steel, freight, and more.